Taxes off paycheck

It is a flat rate that is unchanged. That means that your net pay will be 43041 per year or 3587 per month.

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

The same goes for the next 30000 12.

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

. The amount of income tax your employer withholds from your regular pay depends on two things. How to have less tax taken out of your paycheck. However making pre-tax contributions will also decrease the amount of your pay that is subject to income tax.

New York income tax rate. How Your Washington Paycheck Works. Its a progressive system which means that taxpayers who earn more pay higher taxes.

Taxpayers can help determine the right amount of tax to. The amounts taken out of your paycheck for social security and medicare are based on set rates. Washington income tax rate.

For a single filer the first 9875 you earn is taxed at 10. Withholding is the amount of income tax your employer pays on your behalf from your paycheck. Estimate your federal income tax withholding.

New York Paycheck Quick Facts. There are seven federal tax brackets for the 2021 tax year. The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15.

The information you give your employer on Form. Some states follow the federal tax. Your bracket depends on your taxable income and filing status.

The changes to the tax law could affect your withholding. Census Bureau Number of cities that have local income taxes. IR-2019-178 Get Ready for Taxes.

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. If you make 55000 a year living in the region of New York USA you will be taxed 11959. There are four tax brackets in.

From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. Form W-4 tells your employer how much tax to withhold from each paycheck. Heres how to make it work for you.

You pay the tax on only the first 147000 of your. Census Bureau Number of cities that have local income taxes. These are the rates for.

With the 2019 tax code 62 of your income goes toward social security. Indiana Taxpayer Information Management Engine. Nebraskas state income tax system is similar to the federal system.

The state tax year is also 12 months but it differs from state to state. Federal income taxes are paid in tiers. The amount you earn.

The money also grows tax-free so that you only pay income tax when you. Use this tool to. In North Carolina The state income tax in North Carolina is 525.

10 12 22 24 32 35 and 37. Your average tax rate is. See how your refund take-home pay or tax due are affected by withholding amount.

Whether your taxable income is 40000 a year 400000 or 40 million the first 10000 you earn is taxed the same 10. Therefore it will deduct only the state income tax from your paycheck. Get ready today to file 2019 federal income tax returns.

Here S How Much Money You Take Home From A 75 000 Salary

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

Payroll Taxes Here S A Breakdown Of What Gets Taken Out Of Your Pay And What You Are Taxed On Youtube

Check Your Paycheck News Congressman Daniel Webster

Paycheck Taxes Federal State Local Withholding H R Block

How To Read Your Pay Stub Paycheckcity

Understanding Your Paycheck Credit Com

Understanding Your Paycheck

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

What Is A Pay Stub All Your Questions Answered

Paycheck Calculator Online For Per Pay Period Create W 4

Pay Stub Meaning What To Include On An Employee Pay Stub

Here S How Much Money You Take Home From A 75 000 Salary

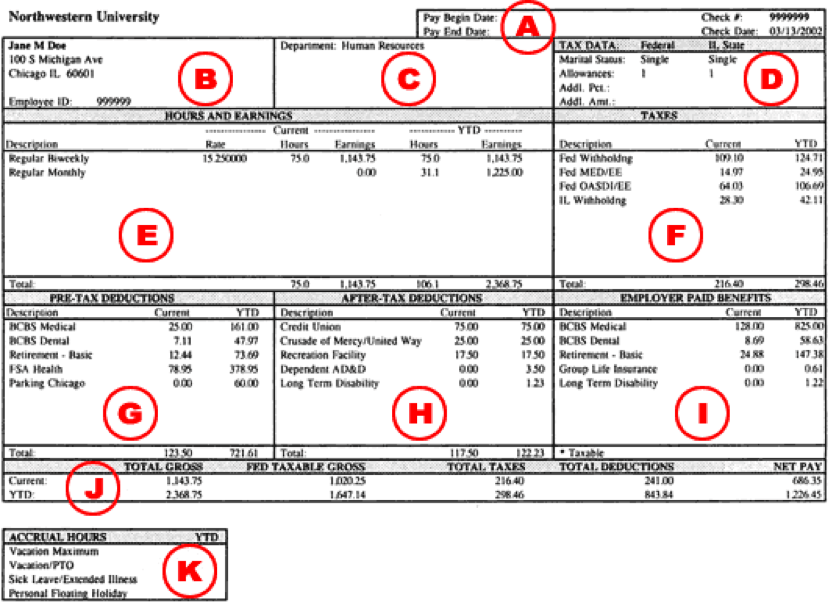

Understanding Your Paycheck Human Resources Northwestern University

Understanding Your Paycheck Youtube